Log in to Manage Your Account using single sign-on via the NatWest Group Benefits Hub.*

Log in using single sign-on* You must be logged in to the NatWest network.

Alternatively, if you don’t want to use single sign-on, you can log in to Manage Your Account directly.

Log in directly

Save

Whether you’re new to pensions or simply new to the Plan, it’s good to think about your contributions and how much you need to save. You can choose how much to save in the Plan and make changes at any time. The more you save, the bigger your pension pot will be when you reach retirement, so it’s important to save as much as you can.

How much should I save?

A rule of thumb is to take your age when you start saving into a pension and use half of that as a percentage of your income. So, if you start saving at age 24, you’ll need to be saving 12%; but if you don’t start saving until you’re 40, you’ll need to save 20% of your salary. As you can see, the earlier you start saving, the better. The good news is that pension saving is a long-term thing and gives you plenty of time to build up a pot of money for your future.

It costs less than you think

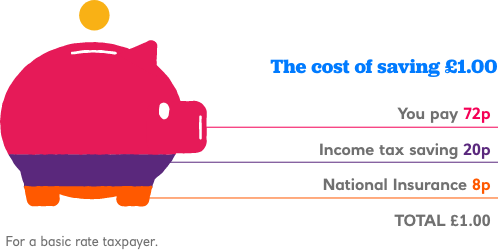

You don’t pay tax on the money that you save into the Plan, within certain limits. This is called tax relief and means your pension contributions cost you less than you might think. They’re deducted from your ValueAccount before your income tax is calculated, and so you make savings on National Insurance too.

Example

If you’re a basic-rate taxpayer, every £1 you contribute into the Plan only costs you 80p. As your contributions into the Plan are paid using salary sacrifice, you also make savings on National Insurance, which brings down the cost of saving £1 even further to around 72p.

The government sets a limit on the amount of pension contributions you can make in a year that get tax relief. This is called the annual allowance and it’s currently £60,000 for most people. If you’re a high earner, your annual allowance might be less than this.

Saving more

When you join the Plan, the bank automatically pays 12% of your ValueAccount directly into the Plan for you each month. You can choose to pay more of your ValueAccount into the Plan by selecting it in the NatWest Group Benefits Hub. You can change the amount you pay in at any time – if you make changes before the end of the month, they’ll take effect from the next month.

Save More Tomorrow

Why not sign up for the bank’s Save More Tomorrow plan? It’s the easy way to save a little bit more. You can automatically increase your contributions by 1% or 2% each year. These increases are timed to happen in tandem with your annual pay review, so the impact of increasing your Plan contributions on your take-home pay is softened. You can make a Save More Tomorrow choice in the NatWest Group Benefits Hub.

Bonus waiver

You can give your pension a boost by paying any bonuses you receive into your pension. Remember that you’ll have to pay income tax on your bonus if you take it as income, but if you pay your bonus into your pension instead, you won’t. This is a good way to boost your pension account balance as well as keep the full amount of your bonus for yourself.

Tax allowances

Saving into a pension plan is a tax-efficient way to save money for your retirement. There are some government limits to the amount of tax relief you can get on your contributions and also on the total amount you can build up in your pension pot. These are:

Annual allowance – the limit on the tax-free amount of money that can be saved into a pension each year. This is currently £60,000 a year. If you want to, you can save more than this into your pension in a year, but any contributions above this amount won’t get tax relief.

Your annual allowance may be reduced if you earn more than £200,000 a year.

If you have flexibly accessed any other pension arrangements, your annual allowance is reduced to £10,000.

If you think these allowances could affect you, please get in touch

Tax-free cash at retirement

If you plan to take some tax-free cash at retirement, you can take up to 25% of the total value of your savings as a lump sum. This amount is capped at £268,275. Any cash you take above this amount is taxed at your marginal rate.

(Monday to Friday, 8.30am to 7pm)